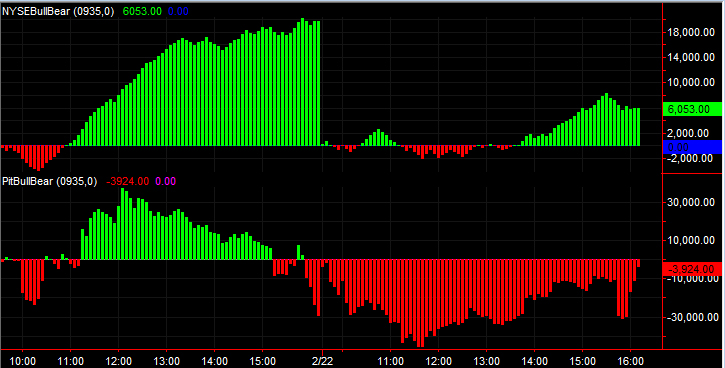

A look at conflict in the cash and futures pit

Posted on | Monday, February 22, 2010 | 1 Comment

Here's a look at sentiment on friday and again today. Note the extreme bearishness in the futures vs the cash today. Compare that to the bullishness from friday in both markets (Green in both, also NYSE sentiment was 20K vs todays's 6K). Friday the pit sentiment dropped off as traders took profits into rising prices, selling high.

Although sentiment increased in the pit this PM, it dropped sharply into the close just after the NYSE sentiment began to decline.

Comments

Archives

-

▼

2010

(56)

-

▼

February

(21)

- Market recap vid for 2/26/2010

- A look at market sentiment ahead of the rally

- Zero Hedge "tired" of seeing computers trade like ...

- A must watch, finally some honesty

- Look at this crap

- A look at conflict in the cash and futures pit

- Market recap for week ending 2/19/2010

- LMAO they DID blame robots for todays market move

- Zero Hedge's new justifcation for spewing falsehoods

- Market recap for week ending 2/12/2010

- Equity market sell off

- Andrew Ross Sorkin

- Banned from twitter?

- The real reason the market won't crash

- I wonder...

- Congratulations!

- Push them lower Tyler you can do it!!!

- The silence is deafening at Zero Hedge

- The futures market must be rallying

- Interpreting volume and why Zero Hedge are morons ...

- A look at inflation vs deflation

-

▼

February

(21)

February 22, 2010 at 1:37 PM

Walter,

This is interesting...what is behind the scenes here? the calculations?

Thanks,

Joe